The

price of LiPF6 is predicted to increase 50% in China next year due to the

increasing demand and its rising cost, according to analysts CCM.

The

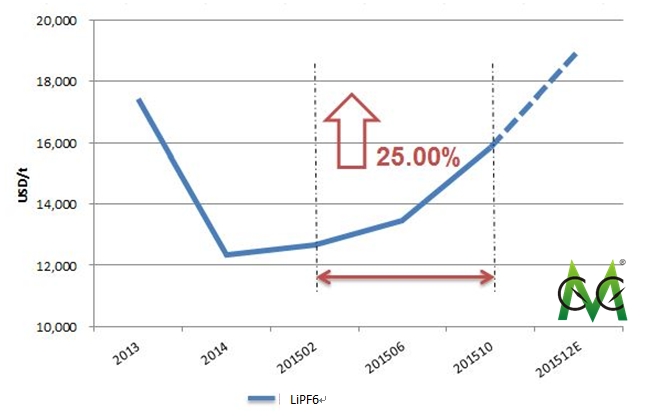

LiPF6 segment has reversed the previous downturns since the beginning of 2015,

and has showed an upward trend in price. By October, the figure has reached

nearly USD15, 834/t, up by 25%, according to data from CCM.

Price

trend of LiPF6 in China, 2013-December 2015E

Source:

CCM

And

Stanley Wang, Chief Editor of China

Li-ion Battery News, predicts that the price of LiPF6 will even rise higher

in 2016:

“China’s

LiPF6 market would continue to grow” said Stanley, “The price is expected to

reach USD20, 585–23, 751/t. The upward trend in LiPF6 price is mainly

attributed to the increasing demand and the cost support.”

Why the price of

LiPF6 keeps rising since 2015?

CCM’s

research indicates that there are 2 main factors behind the recent surge in

LiPF6 price in China – the continuously explosive growth in China’s alternative

energy vehicle, and the increasing cost of one of its major raw material.

The explosive development

in EV boosts the LiPF6 market

The

alternative energy vehicle industry maintains the explosive growth in 2015,

largely pushing up the sales of the upstream- power Li-ion battery and the

battery’s materials like electrolyte, cathode materials and anode materials.

LiPF6,

as the major raw material of electrolyte, also boosts thanks to the great

development in the EV market. The increasing demand of LiPF6 explains why the

price keeps rising.

During

January-October 2015, China produced 181,225 alternative energy vehicles and

sold 171,145 ones, respectively up by 270% and 290% year on year, according to

statistics from the China Association of Automobile Manufacturers.

Such

a high speed growth in EV market is mainly ascribed to the highly concentrated

release and implementation of policies.

The

goal of the production and sales of EV is to be combined to reach 500,000 units

in 2015 and 5 million units in 2020, according to the Energy Saving and

Alternative Energy Vehicle Industry Development Planning (2012-2020) published

in July 9, 2012.

The

sales of alternative energy vehicle are required to account for 5% of the total

vehicle market in 2020, and to reach 20% in 2025, according to the policy of

Made in China 2025 published in May 2015.

However,

the production and sales would only surpass 400,000 units now. And during

January-October, the figure of the sales of alternative energy vehicle was only

0.89%, according to CCM.

“It

is still a long way to go for achieving the goal to produce and sell 5 million

units in total in 2020 and to reach figure, still needs great efforts”

commented Stanley.

“This

growth speed will last for several years, which will surely bring great

opportunities to the related industries” predicted Stanley, “As for its major

and important upstream material- LiPF6, the price may keep growing in 2016,

along with the boosting EV market.”

Lithium carbonate:

the cost of LiPF6 Raw material is rising

Lithium

carbonate, being LiPF6‘s major raw material, has increased in its price recently,

which causes the rising price in LiPF6.

The

globally leading lithium products supplier, FMC Corporation, up-regulated the

price of lithium carbonate by 15% worldwide from 1 October. This further drove

up the global upward trend.

The

average ex-works prices of battery grade lithium carbonate and industrial grade

lithium carbonate in China were about USD9, 062/t and USD7, 606/t respectively

in October, up by 39.59% and 20.08% over January, according to CCM.

The

reason why FMC up-grated the price is mainly attributed to the increasing costs

and decreasing supply of lithium carbonate.

FMC’s

production costs in the Hombre Muerto (salt lake, in Argentina, FMC's largest

lithium production base) rose largely.

During

July-September, the local financial conditions were worsening rapidly - the

galloping inflation (rate at 20%) and the exchange-rate control directly drove

up the production costs for FMC, according to CCM research.

In

addition, the rainy days in the “lithium triangle” (Argentina, Chile and

Bolivia) further caused the rise in cost and fall in output. In Q3, its supply

has decreased by 33% year on year.

To

cope with business crisis, FMC announced on 1 Aug. to up-regulate the prices of

lithium products worldwide, including 20% (= USD1, 000/t) for lithium

carbonate, lithium chloride and lithium hydroxide.

However,

the overall price up-regulations had not yet made up for the cost rises. In a

move to maintain the profit margin, FMC, in October, again raised up the

lithium products prices. Of this, those for lithium carbonate, lithium chloride

and lithium hydroxide were further up by 15%.

“Regarding

to the high supply concentration of lithium products and the shrinkage in its

output, the global supply will continue to be tight in the short run and the

price may keep growing” predicted Stanley.

“With

the increasing cost of LiPF6 raw material, the price of LiPF6 in China will

grow accordingly.” Stanley added.

We

will keep following up on the LiPF6 market in both our China

Li-ion Battery News and China Fluoride Materials Monthly Report.

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets. Founded in 2001, CCM offers a range

of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include

Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For

more information about CCM, please visit http://www.cnchemicals.com

or get in touch with us directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

-

Average:3

-

Reads(2570)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com