Appetitive Chinese enterprises

With a driving demand for overseas branded health care products in China, Chinese companies are now going a step further and looking for takeover targets. The speed of foreign acquisitions by Chinese companies would only be faster.

On 27 June, 2016, CSPC Ouyi Pharmaceutical Co., Ltd. (CSPC) and a Australian healthcare product enterprise, Probiotec Limited, agreed to establish a partnership and will negotiate with each other on detailed information about investment, distribution, product lines and so on.

CSPC is one of China's leading pharmaceutical companies, listed on the Hong Kong stock exchange with a market capitalisation of USD5.3 billion

CSPC general manager Chen Haixiang disclosed that CSPC has been in Australia hunting for buying opportunities.

"After the free trade agreement with China and Australia the economic relationship is getting a lot closer than before, and a lot of Chinese consumers are really interested in Australian quality health products, so that's why we're interested in buying these Australian brands," said Mr. Chen.

Want to know more about CCM's food and feed market products? Click here and download our free sample of CCM Newsletters for Food Industries in China!

Nature's Care Manufacture Pty., Ltd. (Nature's Care), a vitamin supplement producer in Sydney, was also one of CSPC targets, who quoted USD1 billion for the acquisition.

In May this year, the company launched its new premium vitamin product "Nature's Care Pro Series" which is to be available in the Chinese market through Kaola.com, an E-commerce platform in China. Prior to this, "Healthy Care", another product from Nature's Care, had been accessed to Chinese consumers through online platforms.

While in the Canada market, in the first half of July, 2016, the auction on equity of Jamieson Laboratories Ltd. (Jamieson), a leading vitamin health care product producer in Canada, was canceled by its possessor CCMP Capital Advisors Limited Partnership (CCMP Capital).

In this auction, two Chinese enterprises, Shanghai Pharmaceuticals Holding Co., Ltd. (Shanghai Pharm) and By-health Co., Ltd. (By-health) were considered the most potential buyers.

Jamieson was priced USD1 billion+, which is probably the reason for the cancelation. Early in 2014, CCMP Capital bought the company for around USD230 million (CAD300 million).

In 2010, Shanghai Industrial Investment (Holding) Co., Ltd. and Shanghai Pharmaceutical Group reorganized and renamed Shanghai Pharm. And By-health was founded early in 1995 in Zhuhai City, Guangdong Province.

So far, the two have not yet accomplished any overseas acquisition for over USD50 million, despite their great influence in Chinese pharmaceutical market.

In March this year, Hong Kong Bai Rui Co., Ltd. (HK Bai Rui), a wholly-owned

subsidiary of By-health, planned to set up a joint venture with NBTY, Inc.

(NBTY), a well-known dietary supplement manufacturer in the US.

HK Bai Rui will invest USD12.03 million-18.05 million into the venture and hold 60% of the shares. NBTY, with the rest 40% shares, will integrate its two brands, "Nature's Bounty" and "Met-Rx", as well as the multinational online business into the new company.

The Irresistible China health care product market

“During the acquisition, the beyond potential China market of health care product is very appealing for both the Chinese pharmaceutical manufacturers and foreign targets,” stated Shi Xuejian, chief editor of Vitamins China News.

“It’s actually a win-win situation. For both of them, it is a good opportunity to capture the market together,” Shi said.

“After all, Chinese enterprises are very active in Mergers and Acquisitions. Foreign takeovers look more attractive when China’s economy is slowing down,” Shi added.

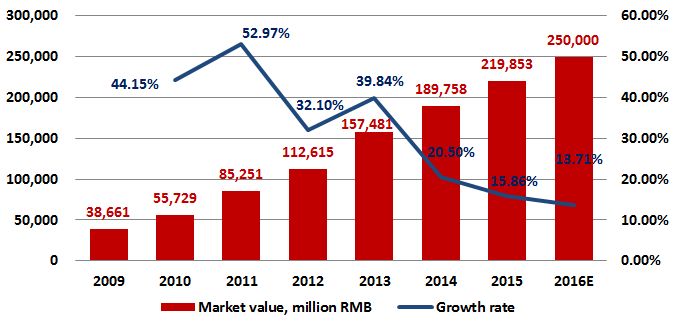

The current market value of health care products in China reached over USD30 billion, with the CAGR of around 20% in the 2011-2015, according to China’s National Bureau of Statistics (NBS). With strong demand for health care products in China, foreign developed brands were competing in the China’s market.

Market value of China health care product (2009-2016E)

Note: Market value = total sales value +imported volume – exported volume; E=Estimated

Source: NBS, China Customs, CCM

“In fact, the fine recognition of foreign developed brands in China is the key reason for Chinese enterprises to acquire the overseas companies of health care products,” stated Shi.

40.98% of Chinese consumers preferred foreign health care products and only 9.49% held the view that “domestic health care products are better”, according to China Consumer Association

Top 5 brands captured 34.9% market share in China’s health care product market in 2015. Amway remained top 1 with the market share of 10.9%, followed by Infinitus Co., Ltd. (China), belonged to a Hong Kong firm; Tiens Group Co., Ltd; and By-health. Also, Nature’s Bounty, a health care brand of NBTY, claimed that it sold several thousand cans of Coenzyme Q10 online on the Black Friday (Nov.11) in 2015 in China.

“Taken over by Chinese enterprises, foreign developed brands could enjoy great convenience to enter the China’s market,” Shi stated.

The emerge of cross-border e-commerce and overseas online shopping, in some way, helped brands to explore the China’s market, such as Blackmores (Australian manufacturer and distributor of vitamins, minerals, and nutritional supplements), Jamieson and Nature’s Bounty.

However, the Chinese government began to crack down the illegal sales of overseas. The China Customs had random checks on the entry products more frequently. In Apr. 2016, the Chinese government began to levy 12% on cross-border E-commerce for the entry products.

In addition, with the implement of Measures for Registration and Filing of Health Care Food in July 1 2016, foreign health care products should get registered in China before selling. That’s to say, overseas companies of health care product have to improve their cost.

“Through the acquisition, foreign companies have built close ties to Chinese enterprises, which is convenient for foreign developed brands to got registered and enter the China’s market,” said Shi.

In 2015, after Swisse, an Australia vitamin brand, was sold to another Hong Kong vitamins firm, Biostime for USD1.7 billion, Swisse chief executive Radek Sali stated that "What's changed for us have been all really positive things. We've turned into an organisation that can now take on a global opportunity.”

"In Australia we have about an 18 to 19% market share - the Australian numbers are somewhat influenced by Chinese local consumers who are purchasing for families and sending product back," Mr Sali added.

You are allowed to download a free sample of CCM Newsletters for Food Industries in China. FREE download now!

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

-

Average:

-

Reads(1507)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com