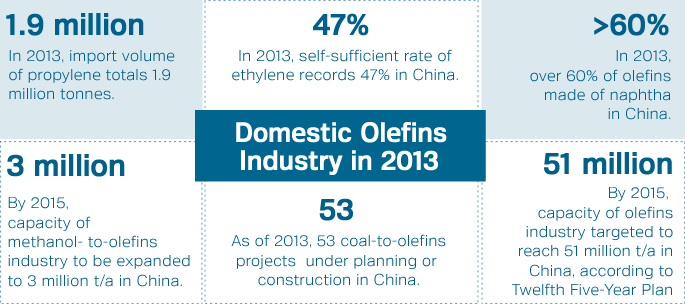

However, still most of the olefins in China are conventionally obtained from naphtha, an oil-based product. It is disclosed that China imported over 50% of its naphtha from overseas in 2013 to produce olefins. Obviously, petroleum's price fluctuations in the world will influence olefins' production costs in China. As a country short of petroleum, the Chinese government resorted to the abundance of domestic coal for the production of olefins. This will relieve the dependence on naphtha, and further reduce the production costs and finally to ensure national raw material security.

Early in 2010, China's first coal-to-olefins project was put into production. Also, it is estimated that China's newly-added capacity of coal-to-olefins or methanol-to-olefins projects will sum up to 3 million t/a in 2013-2015. Furthermore, the capacity of nonpetroleum-based olefins will account for 20% of the total in China by 2020. China is becoming an international hotspot in olefins' industrial production.

Currently, China is witnessing rapid development in coal to olefins. How are the projects going? How will they affect production costs? What will they bring to olefin imports and downstream industries? What are the involved experts' opinions towards olefin development? CCM, a publisher of automated data & information, will maximize its own research skills, collect different views within the industry and grasp factual news and hot issues. This will establish an electronic platform, China Olefins Market E-News for the comprehensive, systematic and professional presence of China's olefin industrial production.

CCM selected the most representative projects like naphtha and coal and imported methanol to do the cost analysis.After checking many times by qualified experts, and combined with the market changes in raw material prices and byproducts, CCM made production cost charts of China's three kinds of ethylene propylene raw materials.Furthermore, consistent with the research and development of the CCM price forecasting model, and based on a large volume of historical data combined with current affairs that may affect the market, CCM will provide clients with the forecast information over the next two months.CCM will provide clients with forecast information for a forecast period of two months. |

Back to Cnchemicals.com

Back to Cnchemicals.com