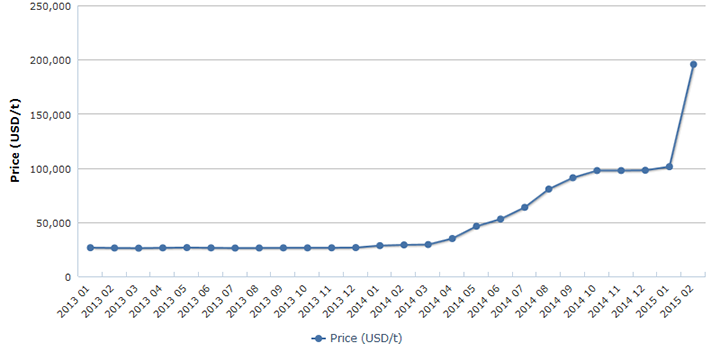

FIGURE1: Market price of 98% feed-grade folic acid in China, January 2013-February 2015

Source:CCM

Folic acid (Vitamin B9) prices in China exploded in H2 2014 as manufacturers curbed production in anticipation of the new Environmental Protection Law. Now, a string of new entrants are seeking to take advantage of the high prices, but this could tip the industry back into overcapacity, according to market research firm CCM.

A string of new folic acid (Vitamin B9) projects have been announced in China in the last six months, as the new entrants look to cash in on an extraordinary spike in folic acid prices that began in March last year.

Up to then, the price of 98% feed-grade folic acid in China had been stable at around 30,000 USD/t, but in H2 2014 a number of manufacturers began to slow down production to reduce pollution emissions ahead of the introduction of tough new environmental regulations in 2015. This caused folic acid output to fall markedly – total output in 2014 was just 1,300 tonnes, a fall of 200 tonnes compared to the 1,500 tonnes produced in 2013.

A shortage of folic acid quickly emerged, sending prices soaring. By October 2014, 98% feed-grade folic acid prices had risen to almost 100,000 USD/t, and by February this figure had reached 195,000 USD/t, a sixfold increase in under a year.

Four major new folic acid projects announced

The high prices have tempted several companies to enter the market, and four major new folic acid projects have been announced in the last six months:

1.Jiangxi Tianxin: 500 t/a folic acid project

On November 26, 2014, Jiangxi Tianxin Pharmaceutical Co., Ltd. (Jiangxi Tianxin) received permission from the regional government in Jiangxi Province to build three new projects in Leping Industrial Park – a 90 t/a vitamin H project, a 45 t/a vitamin D3 project, and a 500 t/a folic acid project. With an investment of USD 86.69 million (RMB 532.93 million), the projects are expected to be completed within the next 25 months.

2.Jiangxi Zhangle: 500 t/a folic acid project

On February 9, 2015, Jiangxi Zhangle Fine Chemicals Co., Ltd. (Jiangxi Zhangle)’s proposed new project – a 5,000 t/a 2,4,5-triamino-6-hydroxypyrimidine sulfate project and a 10,000 t/a sodium methanolate project – passed its environmental impact assessment, which was carried out by Yichun Environmental Protection Agency, Jiangxi Province. The new project will be located in the salt-chemical industrial base, Zhangshu City, Jiangxi Province, and will be comprised of two phases, the first of which includes a 500 t/a folic acid project and the supportive upstream intermediate project. In total, Jiangxi Zhangle will invest USD4.88 million (RMB30.00 million) in this project, and the first phase will cost around USD4.55 million (RMB28.00 million).

3.Anhui Shengda: 600 t/a folic acid and the supportive intermediate project

Just one week later, on February 16, 2015, Anhui Shengda Pharmaceutical Co., Ltd. (Anhui Shengda) published its environmental impact statement for the first time.

4.Shangdong Hongzhi: 300 t/a folic acid project

And on February 25, 2015, Shangdong Hongzhi Biotechnology Co., Ltd. (Shangdong Hongzhi)'s 300t/a folic acid project also passed its environmental impact assessment. This project will be constructed in the New Material Industrial Zone, Dongming County, Shandong Province. The project will utilize the existing manufacturing plant and auxiliary facilities, while all the manufacturing equipment will be completely refitted. It is estimated that the whole project will be completed in October 2015, and the total investment will amount to approximately USD5 million (RMB30 million).

The danger of overcapacity

These new projects will certainly intensify competition in the folic acid industry in China, but there is a risk that they will push the industry back into overcapacity.

Once completed, the four projects will add a combined 1,900 t/a of capacity, which is already more than total global demand for folic acid, which over the last three years has ranged between 1,500 tonnes and 1,650 tonnes, with a CAGR of around 3%.

In addition, China already has over 3,000 t/a of existing capacity, meaning that once the four projects have been completed, the industry will be capable of producing more than three times global demand each year.

Indeed, there is a great danger that the new entrants will send folic acid prices tumbling, undermining the very thing that attracted them to the market in the first place.

There is a direct precedent for this. In 2007, folic acid prices in China also rose steeply after producers slowed down or suspended production for environmental protection reasons – in this case, due to the huge algal bloom that occurred at Lake Taihu. Prices at one point reached 162,668 USD/t, attracting a dozen new entrants to the industry.

FIGURE 2: An algal bloom on Lake Taihu

Source: Adam C. Powell, PhD

However, the fast capacity expansion led to fierce competition, and prices quickly plummeted. By 2009, feed-grade folic acid prices had dropped to just over 32,000 USD/t, and remained at around that level until the latest price spike began in late 2014.

This time around, the one factor that could make a difference is the potential impact of new environmental regulations, which are being implemented this year. CCM estimates that the new regulations will push production costs for folic acid manufacturers up to 48,800 USD/t.

One the one hand, if folic acid prices plunge, the higher production costs will make life even tougher for manufacturers. However, there is a possibility that manufacturers may be shut down temporarily or even permanently for breaching the regulations, which will reduce supply and keep prices high. And several producers may even go out of business, reducing competition in the industry.

CCM will provide regular updates on this situation as it progresses in our China vitamins market e-journal, Vitamins China E-News.

Vitamins China E-News provides instant updates with breaking news, the latest market data, and in-depth analysis of the biggest trends in China’s vitamins market.

To download a free sample of Vitamins China News, click here.

About CCM

CCM is dedicated to market research in China, Asia-Pacific Rim and global market. With staff of more than 150 dedicated highly-educated professionals, CCM offers Market Data, Analysis, Reports, Newsletters, Buyer-Trader Information, Import/Export Analysis, and Consultancy Service.

For more information, please visit http://www.cnchemicals.com

Guangzhou CCM Information Science & Technology Co., Ltd.

17th Floor, Huihua Commercial & Trade Mansion, No.80 Xianlie Zhong Road, Guangzhou 510070, China

Tel: 86-20-37616606

Email: econtact@cnchemicals.com

This article was provided by CCM, a leading provider of data and business intelligence on China's chemicals market.

Contact us:

- LinkedIn: http://cn.linkedin.com/pub/kcomber-inc/9a/964/2b2/

- Facebook: https://www.facebook.com/CCMKComber

- Twitter: https://twitter.com/CCM_Kcomber

-

Average:

-

Reads(7301)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com