Businesses

across Asia are bracing themselves for the impact of ‘super El Niño,’ but the

phosphate fertilizer industry has more reason to fear than most. Here are three

side-effects of El Niño that the fertilizer industry needs to be prepared for…

2015 is set to be a ‘super El Niño’ year. Ocean

surface temperatures near the equator were already 1.4°C higher than normal in

May, according to China’s National Climate Center, leading to South China being

drenched by 50% more rainfall than normal that month.

And the US National Oceanic Atmospheric Administration

predicts that there is a more than 85% chance that this year’s El Niño will

continue through winter, when its effects tend to be more severe.

The dramatic climatic changes that come with El Niño

have the potential to damage business in many different industries, but the

phosphate fertilizer market is likely to be hit harder than most. If the

phosphate fertilizer industry wants to ride out the storm, it needs to be

prepared to deal with this triple-whammy of side-effects:

1. Phosphate

fertilizers will become much less effective in many areas

El Niño years tend to bring extremes of precipitation.

During the last ‘super El Niño’ in 1997, for example, China’s Yangtze River

Basin experienced the worst flooding since 1954, while North China suffered the

driest year in half a century.

Both heavy rainfall and droughts will severely affect phosphate

fertilizer sales. Not only will farmers will use less fertilizer during dry

spells, but they will be more likely to switch to specialized ‘anti-drought’

compound fertilizers. Water-soluble fertilizers, for example, are much more

effective than traditional fertilizers during droughts. Heavy rainfall also greatly increases the

risk of leaching.

2.

Farmers’

finances will be disrupted

The extreme weather will also take its toll on yields.

The 1997 El Niño had a devastating effect on harvests across Asia, with China’s

corn output down 18% on the previous year, Australia’s wheat yields falling

15%, and palm oil harvests in Indonesia and Malaysia 7% and 5% lower than the

previous year respectively.

A decrease in yields will be detrimental to farmers’

incomes anywhere, but any drop will be much more keenly felt in Asia, where 87%

of the world’s family farms under two hectares are located, according to the

Asia Farmers’ Association. For many of these small, low-income farmers, a

decrease in yields will stretch their finances to the point where many will not

be willing to spend so much on fertilizer. This will have a knock-on effect on

sales of all fertilizers, including phosphate fertilizers.

3. Phosphorus

ore prices will rise

Not only will fertilizer companies experience a dip in

sales, but many are also likely to be hit by rising raw materials costs.

China, where a large proportion of the world’s

phosphorus reserves are located, will suffer widespread drought this year due

to El Niño, and this will hinder the extraction and transportation of

phosphorus ore, pushing up prices.

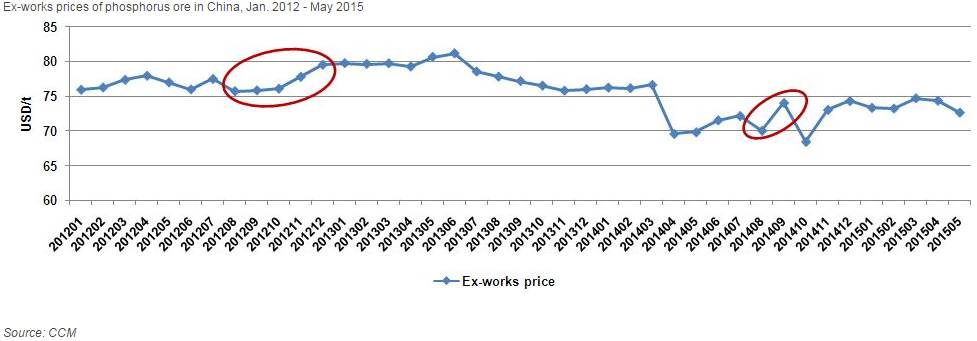

Droughts have sparked increases in phosphorus ore

prices in China twice in just the last three years: once in 2012 after a

drought in Yunnan Province, and another time in August 2014 when drought struck

many different regions across the country. But this time the droughts, and the

price rises, could be much more serious.

If you

would like to find out more about how El Niño will affect your business, please

get in touch by emailing econtact@cnchemicals.com.

For more

information about CCM and our coverage of China’s fertilizers market, visit www.cnchemicals.com or get in touch directly by LinkedIn, phone or email.

-

Average:5

-

Reads(4686)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com