China is on course to import over a sixth of the world's

sorghum this year as the Asian superpower’s new-found hunger for the grain

continues to grow, according to market intelligence firm CCM.

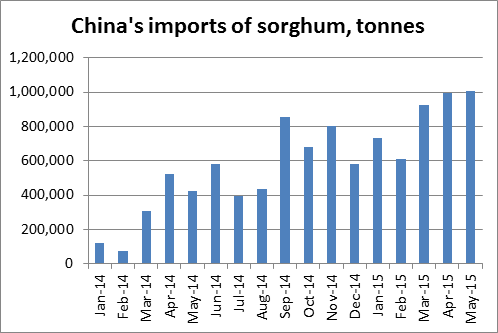

China imported over a million tonnes of sorghum during

May alone, according to data from China Customs, and imports have risen every

month since February.

Unless the Chinese government takes action to curb

sorghum imports, CCM predicts that China will import over ten million tonnes of

sorghum in 2015, more than a sixth of the 59.4 million tonnes the International

Grain Council forecasts will be grown worldwide during the 2014/2015 growing

season.

Source: China Customs and CCM

This spike in Chinese demand is being driven mainly by the country’s feed

industry, which is increasingly turning to sorghum as a cheaper substitute for

corn. Over 80% of the sorghum imported to China is used to produce feed,

according to China’s Ministry of Commerce.

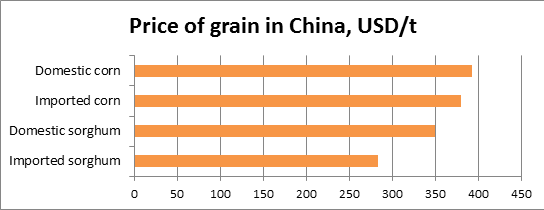

Sorghum’s chief advantage lies in its relative cheapness. The Chinese government’s

policy of stockpiling large quantities of corn has driven up domestic corn

prices to USD393/t[1], almost double prices in the US. However, China also

imposes a hefty 65% tariff on corn imports that raises the price of imported

corn to USD380/t.

At an average price of just USD284/t,

imported sorghum represents an attractive alternative for Chinese manufacturers.

Though its lower nutritional value and tendency to cause constipation

make sorghum unsuitable to completely replace corn, insiders in China’s feed

industry disclosed to CCM that Chinese manufacturers will typically choose

sorghum over corn if the price difference rises over RMB150-200/t

(USD24.5-32.7/t).

With the price difference currently more than triple that figure and no

import quota for sorghum currently in place in China, it is possible that

imports could rise even further in the coming months.

Source: CCM and China Customs

US could lose market share

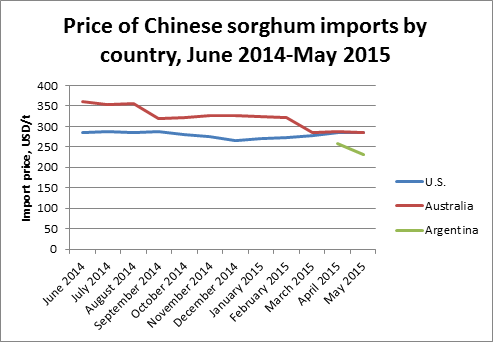

The US

continues to supply the vast majority of China’s sorghum imports but is coming

under increasing pressure from Australia and Argentina.

China sourced 95%

of its sorghum from the US during the first five months of 2015, according to

China Customs data, with Australia accounting for 4% and Argentina just 1%.

However,

Argentinian and Australian sorghum are becoming increasingly price competitive

and could gain market share in H2 2015.

In May, the

price of Australian sorghum dropped below US prices for the first time to just

over USD284/t, and Argentinian sorghum is cheaper still at under USD235/t.

Source: CCM and China Customs

Corn demand weakens further

Meanwhile,

Chinese demand for imported corn continues to weaken, which could put more

downward pressure on corn prices.

China imported

just 140,700 tonnes of corn in April, less than 5% of the country’s total grain

imports during that month, and China National Grain

& Oils Information Center (CNGOIC) predicts that the country will

substitute a total of over 16 million tonnes of corn for sorghum, DDGS or

barley during 2014/15.

What’s

more, CNGOIC forecasts that China’s corn imports will decrease a further 50% during

2015/16.

For more information about CCM and our coverage of China’s grain markets, please visit www.cnchemicals.com.

Notes:

[1]

All price data is as of May 2015. Domestic price data is provided by CCM’s

price monitoring service. Import/export price data is provided by China

Customs.

-

Average:

-

Reads(4715)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com