Feed manufacturers should brace themselves for higher riboflavin (vitamin B2) prices in Q4 as a supply shortage in China starts to bite, says market intelligence firm CCM.

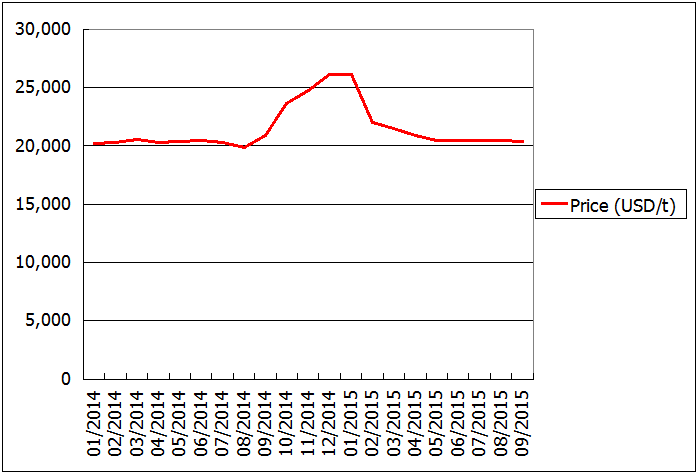

Market price of 80% feed-grade vitamin B2 in China, January 2014-September 2015

Source: CCM

Riboflavin prices in China actually declined slightly during Q3 due to the dramatic decline in the country’s livestock industry, where the number of adult sows fell 14.5% in July alone and poultry numbers also fell significantly. This depressed demand for feed, masking the supply problems in the riboflavin industry.

However, as China’s meat and feed markets have started to recover, supplies of the vitamin have quickly tightened and this is emboldening manufacturers to raise prices.

Hubei Guangji Pharmaceutical Co., Ltd. (Guangji Pharmaceutical), China’s leading riboflavin producer, raised its quoted price for 80% feed-grade vitamin B2 22% between July and October, and the average closing price for vitamin B2 rose as high as USD26,770-28,344/t in October, up from just USD20,471/t in September, according to CCM’s research.

As China supplies 60% of global demand for riboflavin, the higher prices will increase costs for feed manufacturers across the US, Europe and India.

Why riboflavin supplies are so tight in China

Until recently, the biggest problem affecting China’s riboflavin industry was severe overcapacity, rather than supply shortages. In 2014, the industry’s total capacity was 11,000 t/a while output was just 4,400 tonnes.

The fierce competition kept prices brutally low for most of 2014, until a spike in raw material prices forced the leading Chinese manufacturers and BASF to raise by 20-50% in Q4, with smaller producers following suit. Once raw materials supplies stabilized in Q1 2015, riboflavin prices quickly fell again.

However, a series of shutdowns during the summer turned the supply situation on its head.

On May 5, Shandong NB Group Co., Ltd. (NB Group) - at the time China’s third largest producer - announced that it would shut down all its riboflavin production lines and convert them to threonine production, as the company believed this market would offer higher profit margins. These facilities have now resumed production, with CCM’s research indicating that the company is still producing some riboflavin, but in much smaller quantities than previously.

Then, on June 30 came the news that production at both of Guangji Pharmaceutical’s vitamin B2 production lines was being suspended, at a stroke removing 4,800 t/a of capacity from the market.

The company’s 2,500 t/a facility in Mengzhou was shut down for violating environmental regulations, not re-opening until September 25. What’s more, the facility continues to operate at only 60% capacity, most probably because Guangji Pharmaceutical is concerned about keeping its waste water emissions low.

Its 2,300 t/a plant, meanwhile, has been relocated to Wuxue and is currently applying for GMP certification so that it can begin production. However, no date has yet been set for when the new facility will open.

And China’s second largest riboflavin producer, Shanghai Hegno Pharmaceutical Development Co., Ltd. (Shanghai Hegno), suspended production at one of its production lines in Inner Mongolia from July to August for an equipment overhaul, reducing supplies further.

Upwards pressure on prices

With production at all of China’s top three manufacturers therefore disrupted to a greater or lesser extent, riboflavin supplies have been lowered significantly just as demand has started to recover.

And the pressure on supplies is likely to increase in Q4, according to industry sources:

“Since September, many downstream feed clients have nearly consumed their inventories and distributors also have low inventory levels,” said one industry insider.

Riboflavin manufacturers are also likely to be quick to raise prices to make up for the heavy losses they have experienced this year thanks to the livestock market depression and production shutdowns.

Guangji Pharmaceutical reported net losses of USD3.5 million (RMB22 million) in H1 2015, and the company estimates that the Mengzhou plant shutdown will cost it an extra USD0.3 million (RMB1.8 million) in lost revenue.

CCM will continue monitoring Chinese riboflavin prices closely and will post monthly price updates in our Price Monitoring and Vitamins China E-News services.

You can also get comprehensive overviews of China’s vitamins market and long-term forecasts through our latest Industry Reports.

About CCM

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

-

Average:1

-

Reads(5623)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com