The Chinese government is restricting HCFCs’ downstream application in order to upgrade the whole industry through the elimination in HCFCs’ production, according to analysts CCM.

Source: Bing

“The

Chinese government is decreasing the consumption quota of HCFCs in the

industries of refrigeration and air-conditioning, and PU foaming. It indicates

that China is accelerating the elimination in production as to promote its

substitutes HFCs” stated Stanley Wang, Chief Editor of China

Fluoride Materials Monthly Report.

In

the end of Dec., 2015, the Ministry of Environmental Protection of the People’s

Republic of China (MEP) released the production quota of

hydrochlorofluorocarbons (HCFCs) for year 2016.

In

the meanwhile, this year, MEP also released the HCFCs consumption quota, which

is covering in total 34 room air conditioner manufacturers, 18 industrial and

commercial refrigeration and air conditioning enterprises, 11 polyurethane (PU)

foam enterprises, 17 extrusion polystyrene foam enterprises, 1 cleaning

enterprise and 1 pharmaceutical aerosol enterprise.

The

production and consumption quotas involve 5 types of HCFC in particular, namely

difluorochloromethane (HCFC-22), dichlorofluoroethane (HCFC-141b),

chlorodifluoroethane (HCFC- 142b), dichlorotrifluoroethane (HCFC-123) and

chlorotetrafluoroethane (HCFC-124).

Unlike

year 2015, which witnessed a reduction of 10% YoY, the HCFCs production quota

has yet to be further down-regulated this year, as it still presents an overall

value equal to the one of the previous year. The quotas for HCFC-22, HCFC-141b

and HCFC-142b amount to 274,279 tonnes, 66,313 tonnes and 22,845 tonnes

respectively.

Year

2016 is however going to be the beginning of China’s 2nd phase of HCFCs

elimination. During 2016 and 2020, the Chinese government plans to eliminate

35% respectively of the HCFCs’ production and consumption volumes of 2009-2010.

“Consequently,

the equality of the production quota will be optimistically only temporary”

said Stanley.

As for the consumption quota, except for an

up-regulation in the extrusion polystyrene foam industry, the other industries

are showing downward trends. Both industries are clearly displaying relatively

large decreases.

In

the industry of refrigeration and air-conditioning, the consumption of HCFC-22

has been reduced by 8.83% YoY to 67,059 tons, while in the industry of PU

foaming, the consumption of HCFC-141b has been reduced by 27.25% YoY to 2,665

tonnes.

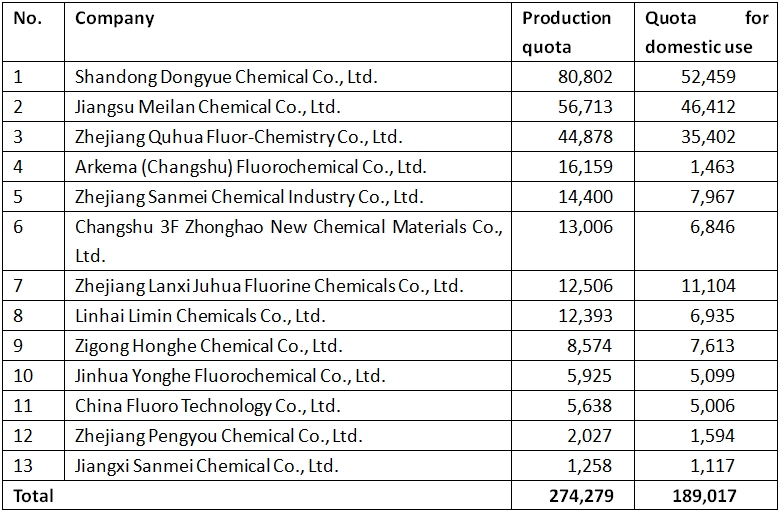

Production quota of HCFC-22 in China, 2016, tonne

Note: The quota for domestic use is part of production quota, indicating that its corresponding products are for domestic sale in China.

Production quota of HCFC-141b in China, 2016, tonne

Source: Ministry of Environmental Protection of the People’s Republic of China & CCM

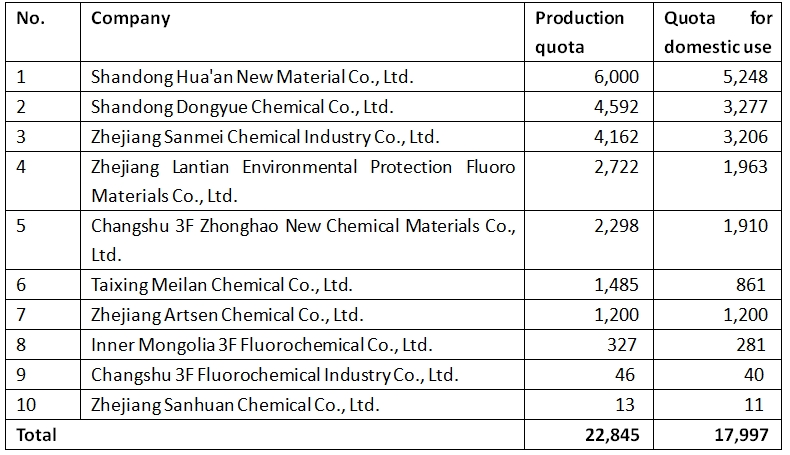

Production quota of HCFC-142b in China, 2016, tonne

Source: Ministry of Environmental Protection of the People’s Republic of China & CCM

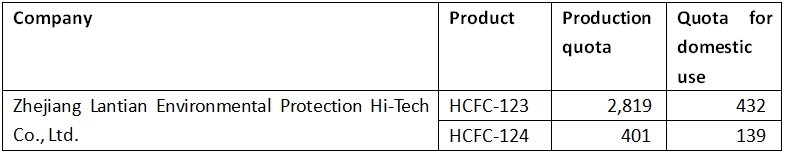

Production quota of HCFC-123 & HCFC-124 in China, 2016, tonne

Source: Ministry of Environmental Protection of the People’s Republic of China & CCM

Now

that many substitutes such as hydrofluorocarbons (HFCs) have been improved for

environmental protection and are finally mature both in technology and for

commercial use.

“It’s

not difficult for downstream enterprises to apply them. They are also now

capable to level up several performance indices for end products” said Stanley.

For

instance, HFC-410a (a 1:1 mixture of difiuoromethane – HFC-32 and

pentafluoroethane – HFC-125), a substitute for HCFC-22 in the field of

household air conditioner, is now widely applied.

At

the same time, air conditioners that use HFC-410a are mostly of variable

frequency, which, compared to conventional HCFC-22 fixed frequency air

conditioners, are more manageable in terms of energy-saving and temperature

control. Thanks to this, the sales of HFC-410a air conditioners are now rising

over 50% in the terminal consumption market.

MEP

is recently promoting the application of some emerging substitution

technologies, such as propane (R290) air conditioners. The main cause of this

decision is the very low global warming potential (GWP) of R290, which is able

to replace high-GWPed HFCs despite having zero ozone depletion potential (ODP).

This is expected to be a significant step forward for the

environmental-friendly application of refrigerants.

While

favourable policies are advanced, the domestic enterprises, such as Gree

Electric Appliances, Inc. of Zhuhai, Midea Group Co., Ltd., Haier Electronics

Group Co., Ltd., TCL Corporation, China Yangzi Group Chuzhou Yangzi Air

Conditioner Co., Ltd. and Sichuan Changhong Air Conditioner Co., Ltd., have

officially launched R290 air conditioners onto the market.

In

addition, it is specified in the First Catalogue of Recommended Substitutes for

HCFCs (Exposure draft), which has been released in early June 2015, that the

downstream should switch to natural products. For example, in the industry of

refrigerant, it is better to use R290, isobutene (R600a), CO2 and ammonia, etc.

As for the industry of foaming agent, it is suggested to use CO2, cyclopentane,

n-pentane, isopentane, etc.

If

you need more information about HCFC in China, why not get a free-trial of CCM’s Online

Platform? You can get much more information about HCFC or even the whole

fluoride market in China for FREE!

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include

Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For

more information about CCM, please visit www.cnchemicals.com

or get in touch with us directly by emailingecontact@cnchemicals.com

or calling +86-20-37616606.

-

Average:

-

Reads(2844)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com