Thanks to the rapid development of alternative energy vehicles in China, the core materials for the batteries are all in the spree of price rising. CCM’s here to compare the differences on the price hyping among battery grade lithium carbonate, LiPF6 and electrolyte.

Comparison on the

rising price

Lithium

carbonate

Lithium

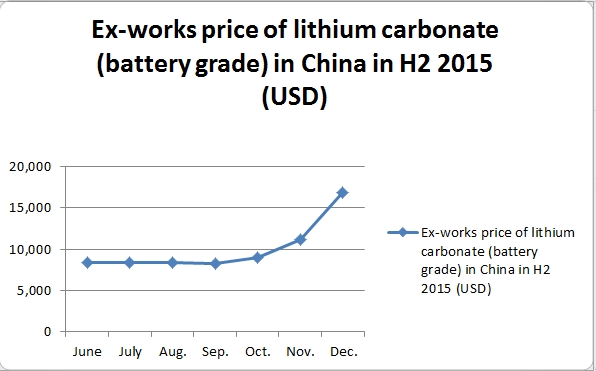

carbonate is a necessary raw material to produce cathode materials of lithium

battery and electrolyte. To produce li-ion battery needs battery grade lithium

carbonate. In the early 2015, the price was about USD6, 615/t. In the end of

Sep. 2015, the price rose to about USD8, 461/t. Till now, the fluctuation of

price experienced 3 periods:

Source: CCM

The

first period was from the end of Sep. to the end of Oct. in 2015. What led to

price to rise was that, FMC Corporation, the lithium carbonate giant,

up-regulated the price of lithium carbonate by 15% worldwide from 1 Oct. 2015.

Since then, the enterprises in China followed it lead and raised the price

successively. Till the end of Oct., the price of lithium carbonate increased to

about USD10, 769/t, up in 27% in just one month.

The

second period was from Nov. to the middle of Dec. in 2015. Thanks to the

increasing sale volumes of alternative energy vehicles in China, the price of

battery grade lithium carbonate rose rapidly. In Oct. and Nov., the enterprises

in China kept increasing the price. Till the middle of Dec., the quoted price

went up to about USD16, 153/t, up in 50% month on month.

The

third period is from the middle of Dec. in 2015 to now. Currently, the price

has no sign to fall. Actually, the quoted price from some enterprises has gone

up to USD23, 076/t, up in over 300% compared to the early in 2015.

LiPF6

LiPF6

is a core material to produce electrolyte, however, it is very difficult to

produce LiPF6 in the technical level. The price was about USD13, 076/t in the

early of 2015. Later, due to the limits of supply, the price kept rising. In

the early of Dec, the quoted price was USD30, 769/t. Some current quoted price

even went up to USD40, 000/t.

Electrolyte

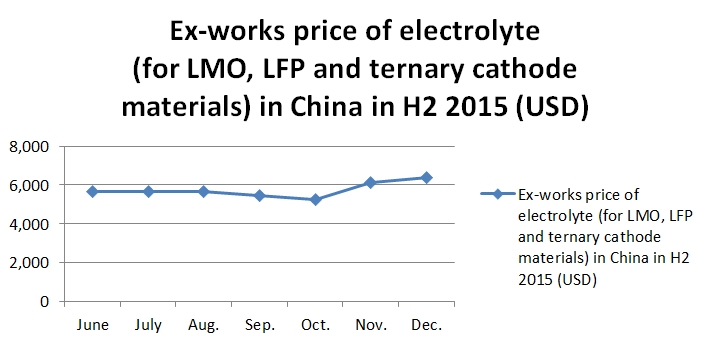

Electrolyte

is the weakest material in the “price to rise” among four raw materials to

produce lithium battery because the industry already stuck in overcapacity.

Thus, electrolyte has very low profits for the enterprises.

The

increasing price of LiPF6, one of electrolyte’s raw materials, has brought

quite a lot pressure on electrolytes’ enterprises. There was news that some

electrolyte companies had asked the downstream clients to raise the price of

electrolyte in their orders.

Source: CCM

Comparison on market

response

Facing

the rising price of lithium carbonate, the stock of Tianqi Lithium began to

rise immediately. Till the end of Dec. 2015, the stock of Tianqi Lithium rose

from USD7.69/share to USD26.15/share, with an increase of 250%. Followed by

Jiangxi Ganfeng Lithium Co., Ltd, its stock increased from USD2.76/share to

USD10.15/share, up almost 300%.

Till

the end of Dec., the stock market of LiPF6 looks quite slow while the

do-fluoride stock market “secretly” rushed to USD15.38/share from 2.61/share.

The stock of China Tinci went all the way to USD14.6/share from USD6.15/share.

Comparison on the

causes

The

imbalance between the supply and demand of lithium carbonate is the main reason

to cause its increasing price.

The

downstream enterprises expanded their capacity successively in 2015. Also, due

to the unknown changes of subsidy policy of alternative energy vehicle from the

Chinese government (the Chinese government may cut down the subsidy), many

enterprises seized to distribute their products to grasp the market share,

which had led to the peak of the demand for raw materials.

Moreover,

it was the winter shutdown of the salt lake and the delay in the production of

newly-constructed lithium carbonate projects that resulted in no substantial

increase in supply in the short run.

With

the rapid demand of alternative energy vehicles, the price of lithium carbonate

continued to grow. In the future, CCM believes that the enterprises of lithium

carbonate will have great performance.

The

increasing price of LiPF6 is also caused by the insufficient supply.

The

expansion period of LiPF6 lasts for one and a half years. Although

manufacturers of LiPF6 began to expand their capacity from Oct., with the long

expansion period, the new capacity of LiPF6 is still very limited and the gap

between supply and demand will keep enlarging. Thus, its price will keep rising

which greatly benefits the manufacturers’ profits.

As

for electrolyte, its high cost pushes its high price. Due to the rapid growth

of its raw material and its weak bargaining ability in the downstream, the

profits for the enterprises won’t increase too much even with the increasing

price.

All

in all, the irrational rising prices of lithium carbonate and LiPE6 are caused

by the increasing demand and insufficient supply, which will be beneficial for

the enterprises’ profits. With the long period of expansion, it is difficult to

narrow the gap between demand and supply. Thus, lithium carbonate and LiPE6

will continue to be at high price.

However,

the increasing price of electrolyte is not able to earn a lot of profits for

the enterprises. We should not have much anticipation.

If you need more

information about lithium carbonate, LiPF6 and electrolyte in China, why not

get a free-trial of CCM’s

Online Platform? You can get much more information about the whole li-ion

battery market for FREE!

* Access to CCM’s entire resources, literally

* Over 180,000 reports, news, data

* Across over 15 segment industries

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include

Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For

more information about CCM, please visit www.cnchemicals.com

or get in touch with us directly by emailingecontact@cnchemicals.com

or calling +86-20-37616606.

-

Average:

-

Reads(3124)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com