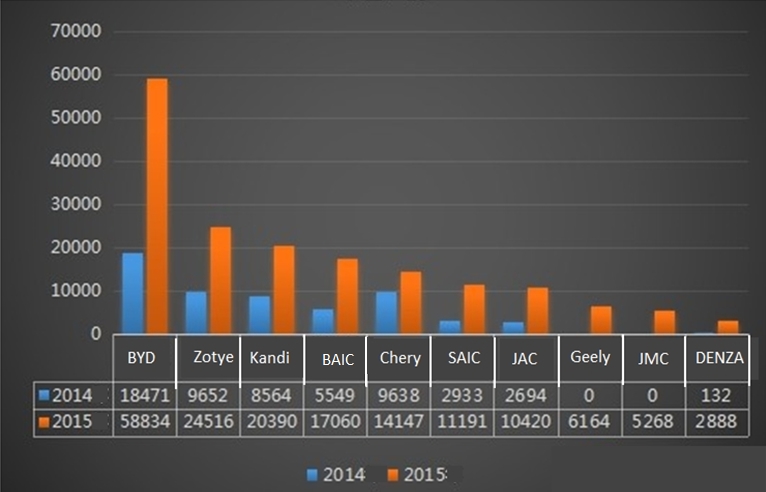

Recently, the manufacturers of alternative energy vehicle shared their sale performance in 2015. According to China Passenger Cars Association (CPCA), BYD, Zotye Auto, Geely Auto and BAIC Motor ranked top 4 in the list 2015 sale volumes of alternative energy passenger cars. The vehicle types like Kandi-Panda, BAIC Motor-E Series, Zotye Auto-Cloud, Geely Auto-Know beans also had great performance. However, the main manufacturers of alternative energy vehicles were not satisfied with the list.

2015

Top 10 vehicle manufacturers in sale volumes of alternative energy passenger

cars

Source: CPCA

Except

for BYD, the cheap and small electric vehicles occupied the top. In fact most

of the vehicles are just simply revamped by adding the 3-eletronic system (battery, electrical machinery and electronic control) based on the

A0 grade cars. That’s to say, the vehicles are 3-low products with low cost of

development, low technology and low price, which has squeezed the development

of the new alternative energy vehicles with high cost and high technology.

The

cheap and small electric vehicles have become the winners in the China

alternative energy vehicles market in 2015. They have occupied 66% in the total

sale volumes of 130,000 of domestic battery electric vehicles.

Among

the Top10 vehicles, the vehicle types of BAIC Motor, JAC, SAIC and BYD enjoy the

highest speed at 120-130 kilometers, according to their official websites,

while the hot-selling cheap and small vehicles only have the highest speed at

about 80 kilometers.

Though

the driving ranges claimed by the cheap and small electric vehicles are over

200 kilometers, in reality, it is difficult for them to reach the driving

ranges what they claim due to the decline of the battery.

Excessive subsidies

from the Chinese government

In

fact, there were many controversies in the market when these small electric

vehicles were launched. The qualities of this type of small electric vehicles

are considered close to the qualities of low-speed electric vehicles.

It

is stated clearly by the Chinese government that: “Till 2015, the highest speed

of the pure electric passenger vehicles and plug-in hybrid electric passenger

vehicles should not lower than 100 km/h”, according to the Development Plan on

Energy Saving and Alternative Energy Vehicle Industry (2012-2020).

However,

in the subsidy system, the pure electric passenger vehicles can still get the

subsidies with the highest speed at 80 km/h. The small electric vehicles can

also receive the 1:1 subsidy from the Chinese government and the local

government, with the amount up to about USD9,692 per car.

“It

is exactly the 1:1 subsidy policy that why the small electric vehicles occupied

the top of the list” stated Stanley Wang, Editor of China

Li-ion Battery News.

In

fact, the 1:1 subsidy policy means that the local government should give the

subsidies to the each electric car manufactured as the same amount as Chinese

government gives to the manufacturers.

“The

subsidy from the local government is a little bit too much, especially for the

small electric vehicles. The subsidy from the Chinese government is already

enough to make up the cost difference between the traditional vehicles and

electric vehicles” said Stanley.

The

subsidy from the Chinese government is calculated according to the battery

cost, thus it won’t be too much to all types of vehicles. But with more

subsidies from the local government, there is no cost or even negative cost for

manufacturing a small electric vehicle.

When

looking at the alternative energy vehicle policies in Europe, USA and Japan,

their subsidies are mainly used in supporting the enterprises to develop and

construct public charging piles. As for personal users, the governments will

give priority to them in using the roads and parking spots, also, the

governments will cut down a bit of taxes on personal users.

Again

back in China, the supporting policies for alternative energy vehicle include

subsidies, reduction on taxation and no charge of the license fees, which is

much too “encouraging”.

The Chinese

government is weakening the subsidy policies

Fortunately,

the Chinese government has realized the problem and decided to stop being such

“encouraging”.

Actually,

the Chinese government began to adjust its policies, according to analysts CCM.

The

subsidy policy for alternative energy vehicle for 2016-2020 published in Apr.

2015 showed 2 big directions clearly.

Firstly,

the government has increased the entry of subsidy: battery electric passenger

vehicles should reach the highest speed of 100km/h with the driving ranges over

100km, which has excluded many small battery electric vehicles with

low-speech.

Secondly,

the government has decreased the amount of subsidy. Compared to the high

subsidy in 2015, the subsidy in 2016 has decreased a lot. The government will

lower 20% of the subsidy every 2 years. That is to say. In 2017 and 2018, the

subsidy will be 20% lower than that in 2016; in 2019 and 2020, it will be 40%

lower than that in 2016.

The

latest policy – Incentive Policy for

Alternative Energy Vehicle Charging Infrastructure during the 13th Five-year

Plan (2016-2020) - published by the Chinese government in Dec. 16 2015

again shows another 2 directions in developing the alternative energy vehicles.

Firstly,

the government will increase the subsidy for charging infrastructures. In the

past, the encouraging policies were all revolved around the manufacturers and

vehicles. The

latest policy gave priority to the charging infrastructures and clearly

stated that there would be incentive standards for constructing charging

infrastructures.

Secondly,

the Chinese government will clear up the regional protectionism. The latest

policy targets the nationwide. In the past, it mainly focused on

Beijing-Tianjin-Hebei Region, Yangtze River Delta and Pearl River Delta.

Now,

the Chinese government has made different goals for the air-polluted areas,

the central areas and other areas. The areas which promote alternative energy

vehicle better will be rewarded accordingly.

Take

the air-polluted areas as an example, in 2016, the goal for the area is to

promote 30,000 alternative energy vehicles. If it can achieve the goal, the

Chinese government will offer a monetary reward about USD13.84 million for

constructing the charging infrastructures.

“It

is very clear that the Chinese government will stop being so general in the

subsidy policies in the alternative energy market” said Stanley.

“It

is believed that the Chinese government will be stricter in the inspection of

the vehicles in next round of promotion”

“The

goal setting is actually putting pressure on different local government” he

added.

If you need more

information about alternative energy vehicles in China, why not get a

free-trial of CCM’s

Online Platform? You can get much more information about alternative energy

vehicles or even the whole li-ion battery market for FREE!

u Price of 1

report = the entire database worth millions of dollars

u Direct

contact with our internal experts

u Fortune

500 companies designated

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include

Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For

more information about CCM, please visit www.cnchemicals.com

or get in touch with us directly by emailingecontact@cnchemicals.com

or calling +86-20-37616606.

-

Average:

-

Reads(3653)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com