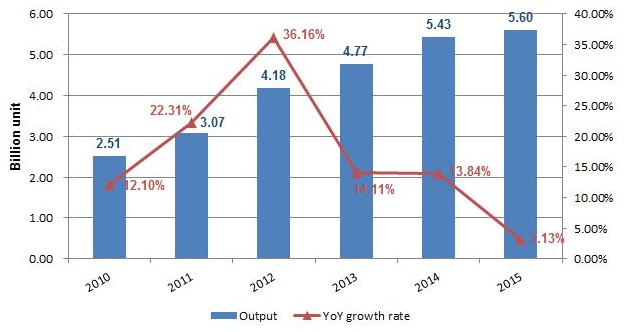

Output and YoY growth rate of Li-ion battery in China, 2010–2015

Source: National Bureau of Statistics of the People’s Republic of China

On 3 March 2016, data from the National Bureau of Statistics of the People’s Republic of China (NBS) showed that only 5.6 billion pieces of Li-ion batteries were produced in China last year, up by 3.13% YoY over the 5.43 billion pieces in 2014. Obviously, the increase of Li-ion battery output has slowed down, comparing with the 10% annual growth rate in previous years.

However, CCM believed that it was not the growth rate of output but the growth

rate of battery capacity that could reflect the real situation of Li-ion

battery industry, because most domestic power Li-ion batteries (for alternative

energy vehicles) are large-capacity soft Li-ion battery cells packs.

Actually, China’s Li-ion battery market structure is changing smoothly.

Significant changes in application

With the declining of the consumer and storage Li-ion batteries, the power Li-ion batteries began to capture the market share thanks to the development of alternative energy vehicles.

In the consumer electronics market, at present, the overall annual output

increases steadily, but some products witnessed a YoY decline. This led to

record weak demand for Li-ion battery in 2015.

1.82 billion mobile phones were produced in China in 2015, up by 3.9% YoY; while 175 million notebook computers (including tablet PC) were manufactured, down by 16.8% YoY; and the output of digital cameras was only 19.227 million, down by 20.4% YoY.

However, Chinese Li-ion battery industry has been driven by the alternative

energy vehicle industry, which began to develop rapidly since 2014. The

domestic output of alternative energy vehicles was increasing rapidly, thanks

to the promotion by the national and local governments.

In

2015, the domestic output of alternative energy vehicles was 379,000, an

increase of 400% YoY.

The changes of consumption pattern helped increase the market share of power

Li-ion battery in domestic Li-ion battery market. In 2014-2015, the market

share of power Li-ion battery has soared from 13% to 52%, exceeding that of

consumer Li-ion battery, whose market share has dropped from 83% to 46%.

Changes in industrial distribution

Changes of the application of Li-ion battery led to polarization in regional industrial distribution.

The top 3 production areas of traditional Li-ion battery in China are the Pearl

River Delta Region (including Guangdong and Fujian provinces), the Yangtze

River Delta Region (including Shanghai, Jiangsu and Zhejiang) as well as the

Beijing-Tianjin-Hebei Region (including Beijing, Tianjin, Hebei).

Due to the rapid development of alternative energy vehicle market and the

industrial transfer, the former region further strengthens its leading

position, while the positions of the latter two are declining. The output of

Li-ion battery in this 3 production areas in 2015 were as follows:

Pearl River Delta Region: increased by 20% YoY to 3.04 billion pieces, accounting for 54.3% of the national total. Amongst them, 2.36 billion pieces were from Guangdong Province, accounting for 42.1% of the national total.

Yangtze River Delta Region: dropped by 5.2% YoY to 1.09 billion pieces, accounting for 19.5% of the national total. This was mainly due to environmental constraints.

Beijing-Tianjin-Hebei Region: dropped by 20% YoY to 440 million pieces, accounting for 7.9% of the national total. This was mainly due to the acceleration of industrial transfer in the region.

“In 2016, China's Li-ion battery market structure is expected to change further,”

stated Stanley Wang, Chief Editor of China

Li-ion Battery News.

“The market share of consumer Li-ion battery will continue to decline while that of Li-ion battery will continue to increase. This is because the consumer electronics market is nearly saturated,”

“The

alternative energy vehicle market will maintain the momentum of rapid growth,

pushing by the target of consuming 5 million alternative energy vehicles by

2020,” Stanley added.

For more information about the li-ion battery market in China, you can try searching in CCM’s Online Platform.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

-

Average:

-

Reads(2734)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com