The first half of the year means peak season for the production and sales of pesticides in China, because farmers should be busy cultivating the lands. However, the whole China’s pesticide market remains depressed since H1 2016, which is inevitably causing the fall of the herbicide market.

“The falling transaction prices of the popular products like paraquat, glyphosate and glufosinate-ammonium have dragged down the whole herbicide market” stated Chen Zaoqun, editor of Herbicides China News.

“Although transaction volumes of glyphosate and glufosinate-ammonium showed an upward trend thanks to the filling up of some market shares left by paraquat AS, glyphosate and glufosinate-ammonium markets were still sluggish” said Chen.

Bumpy glyphosate market

It has been hard for the glyphosate market. Just after the United Nations and the World Health Organization reported that there is no actual danger for glyphosate to cause cancer to human, glyphosate has again to face hindrance in receiving its registration approval and renewal registration in the European Union (EU) market.

In June 2016, the EU decided to re-authorize glyphosate for further 18 months, and in July, EU countries accepted related limiting conditions for using glyphosate, including forbidding adding POE-tallowamine into glyphosate herbicides; limiting applying glyphosate in special areas like parks and playgrounds; and protecting the underground water, especially the water for non-crop use.

However, the future of glyphosate still remains to be seen in the EU market.

“If glyphosate is banned after 18 months, then its circulation and development in the world will be greatly impacted – the sales will be hindered in the EU market and other countries might follow the EU's example and ban glyphosate”, said Chen.

At the moment, the glyphosate market is still in bad shape in China, with a sufficient market supply but a limited downstream demand especially from overseas.

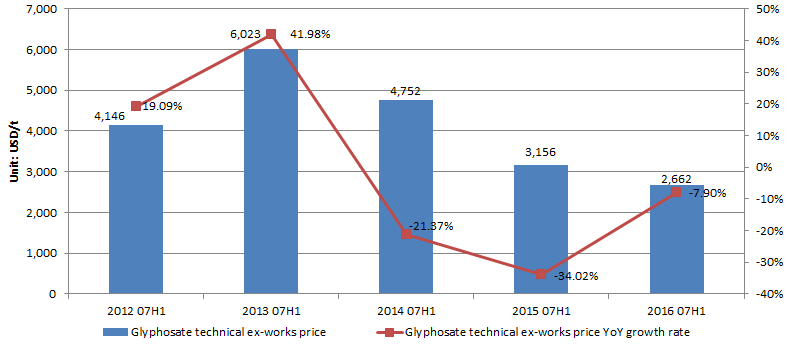

In the first half of July, the ex-works price of glyphosate 95% TC was USD2,662/t, down 0.14% MoM, hitting a record low again. In Jan.-July, the average ex-works price is USD2,763/t, also a record low in recent 5 years, according to CCM price monitoring.

Ex-works price of glyphosate technical and its YoY growth rate, July 2012-July 2016

Note: 1. The price change is calculated from RMB quotations.

2. Prices are monitored at the middle of every July from 2012 to 2016.

Source: CCM

CCM predicted that the market is going to stay depressed in the long term with rigid demand. Consequence of that, the price will stay low.

Price of glufosinate-ammonium hit a record low

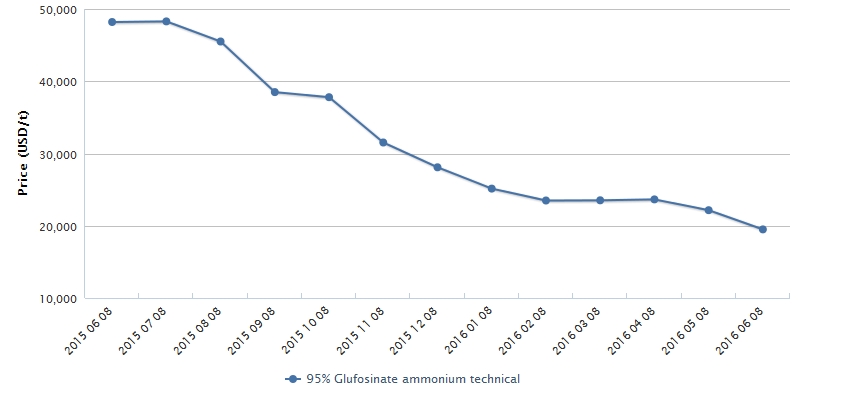

The ex-works price of glufosinate-ammonium in China kept falling and falling and recorded a new low. The average ex-works price of 95% glufosinate-ammonium TC fell to USD19,488/t in the first half of June 2016, down by 22.48% over USD25,139/t in Jan. 2016 and, by 40.43% YoY, according to CCM's price monitoring

Ex-works price of 95% glufosinate-ammonium TC in China, June 2015-June 2016

Source: CCM

Some insiders disclosed that if the price keeps falling, those glufosinate-ammonium enterprises with less competitiveness have no choice but to suspend production. Although some believed that the price has dropped to the bottom and will not be likely to reduce further, the downward trend continues.

Although the transaction volume of glufosinate-ammonium TC rose due to the exit of paraquat AS in the China’s market and higher cost performance of glufosinate-ammonium formulations than that of glyphosate, the rapidly expanded production capacity leads to serious oversupply.

Currently, most of the major Chinese glufosinate-ammonium manufacturers have plans for capacity expansion.

Zhejiang Funong Bio-technology Co., Ltd. has the glufosinate-ammonium capacity of 3,000 t/a. Glufosinate-ammonium capacity in Sichuan Lier Chemical Co., Ltd. reached to 3,600 t/a and it planned to have 17,600 t/a total capacity for glufosinate-ammonium in the near future.

In addition, a production line of 600 t/a glufosinate-ammonium capacity from Inner Mongolia Jiaruimi Fine Chemical Co., Ltd. has already put into trial production with rest 4 production lines would be completed in 2017. By that time, the total glufosinate-ammonium capacity would reach 3,000 t/a.

Hebei Veyong Bio-Chemical Co., Ltd. has 450 t/a glufosinate-ammonium capacity now and planned to have 4,450 t/a in total.

Exit of Paraquat in China

Industry insiders are worried about the future of paraquat as it is likely to be banned by the international market.

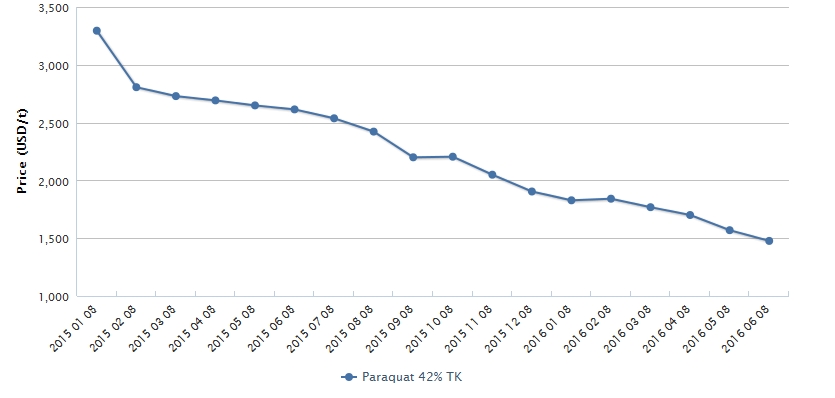

The ex-works price of paraquat keeps declining sharply. The ex-works price of 42% paraquat TK was USD1,477/t in the first half of June 2016, dropped by 19.20% if compared with the USD1,828/t in Jan. 2016 and by 43.50% if compared with the USD2,614/t in June 2015, according to CCM's price monitoring.

Monthly ex-works price of 42% paraquat TK in China, 2015-2016

Source: CCM

Now, the Chinese enterprises have to take measures to cope with the continuously falling paraquat price. Shandong Luba Chemical Co., Ltd. has disclosed to invest a large sum in developing pyridine series, in order to ease the impact on the ban of paraquat in China.

While Nanjing Red Sun Co., Ltd. has decided to reduce paraquat TK capacity to 20,000 t/a from 48,000 t/a and vigorously develop downstream products of pyridine.

As summer comes, domestic pesticide TC market enters slack season, but the demand for sterilant herbicides and wheat herbicides is still strong. Some products are likely in tight supply because environmental protection calls for capacity reduction. As a result, in Q3, seasonal products that are in demand will draw great attention, and their prices may fluctuate, according to Chen’s prediction.

*CCM is attending AgriBusiness Global Trade Summit at Booth#24 in August 17-19 in Orlando, Florida, U.S.A. See you there!

For more information about glyphosate, glufosinate-ammonium, paraquat or any other herbicides, search in CCM’s Online Platform now!

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

-

Average:

-

Reads(1380)

-

Permalink

Back to Cnchemicals.com

Back to Cnchemicals.com